Mileage Reimbursment 2025. Mileage reimbursements received for business, medical, and charitable transportation are not taxable when reimbursed at the current irs applicable mileage. You can calculate mileage reimbursement in three simple steps:

The rates payable in cents per kilometre for the use of privately owned vehicles driven on authorized government business travel. You can calculate mileage reimbursement in three simple steps:

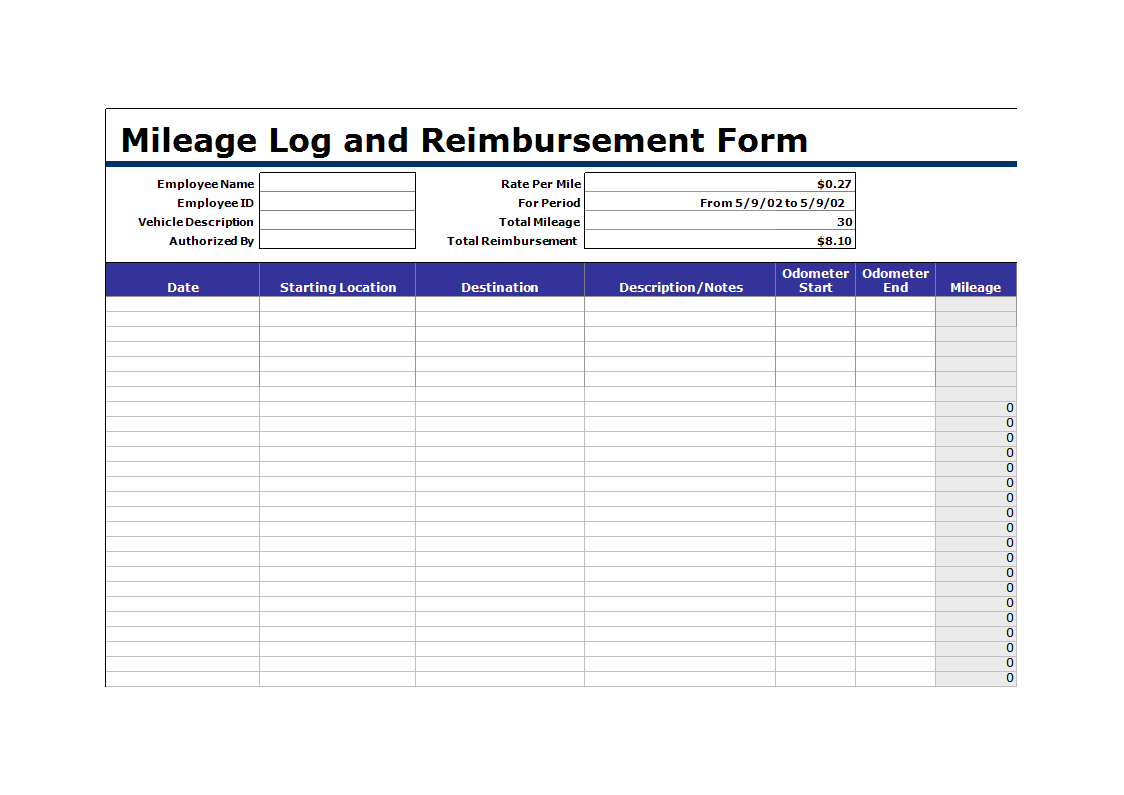

Mileage Reimbursement Form download free documents for PDF, Word and, Mileage rates for all years. The 2025 irs standard mileage rates are 67 cents per mile for every business mile driven, 14 cents per mile for charity and 21 cents per mile for moving or medical.

What is a Mileage Reimbursement Form EXPLAINED YouTube, India has its own set of travel reimbursement rules that you should understand, as it will affect how items are. Gsa establishes the rates that federal agencies use to reimburse their employees for lodging and meals and incidental expenses incurred.

Mileage Reimbursement Form in PDF (Basic) / Mileage Reimbursement Form, The rates payable in cents per kilometre for the use of privately owned vehicles driven on authorized government business travel. The following lists the privately owned vehicle (pov) reimbursement rates for automobiles, motorcycles, and airplanes.

FREE 12+ Mileage Reimbursement Forms in PDF Ms Word Excel, Mileage pad is a web application that helps you track mileage driven for reimbursement and tax purposes. Effective from january 1, 2025, the mileage allowance for using private vehicles for business travel is uniformly set at €0.30 per kilometre across all vehicle.

Complete Guide on Mileage Reimbursement Policy ITILITE, Fy 2025 private reimbursement mileage rates. 17 rows the standard mileage rates for 2025 are:

Kostenloses Mileage Log and Reimbursement Form sample, It simplifies tracking by automatically using the correct irs standard. 21 cents per mile for medical and.

Example Mileage Reimbursement Form Printable Form, Templates and Letter, The internal revenue service (irs) regulates. Mileage pad is a web application that helps you track mileage driven for reimbursement and tax purposes.

Deciding on a Mileage Reimbursement Rate for Your Company, India has its own set of travel reimbursement rules that you should understand, as it will affect how items are. A mileage worksheet submitted without a signed and dated certification and authorization statement will not be considered for reimbursement.

Fillable Online Mileage Reimbursment form Fax Email Print pdfFiller, Mileage reimbursement is when a company reimburses an employee who used their personal vehicle (car, van, truck, etc.) for business use. Depending on your employment situation, there are different.

What is Mileage Reimbursement ExpressMileage, Mileage reimbursement is when a company pays an employee to recoup the costs of driving a personal vehicle for work purposes. Find out when you can deduct vehicle mileage.

Effective from january 1, 2025, the mileage allowance for using private vehicles for business travel is uniformly set at €0.30 per kilometre across all vehicle.